What’s New

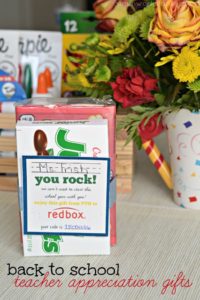

Back to School Teacher Appreciation Gifts + a Tutorial

It's the start of a new school year and to show our teachers some back to school love, we've created this simple back to school teacher appreciation gift! Ahhhh! The most wonderful week of the year. Back to school week. Where the kids head back into the loving arms of their teachers and mama gets some time to work uninterrupted (well... with the baby). While they enjoy learning and playing and being taught by someone other than me, I can get things done and FINALLY get back to a … [Read More]

How to Make a DIY First Day of School Sign Using PicMonkey

My oldest will be heading to kindergarten in just two short weeks. And while I'm definitely ready for this next step in his adventure, I want to make sure to capture as many memories as I can. So after seeing a lot of printables floating around, I decided that instead of finding something someone else made, I'd make my own DIY first day of school sign. With the help of PicMonkey it was not only easy to do, but it came together very quickly! And it cost nothing for me to make. I simply used … [Read More]

Back to School Lunch Ideas and Tips

Ever start thinking of school lunches and wonder what the heck you're going to pack? Well here are some great back to school lunch ideas and a few tips that might help you out! My son isn't quite ready for kindergarten yet but will be there next year and we've already exhausted a few great ideas for toddler lunches at home. So I'm trying to gather a bunch of ideas and tips so that when I am packing his lunch I can pack something that he'll enjoy and actually eat. Good thing I have a whole … [Read More]

DIY Shamrock Shirt with 4-Leaf Cover Stamp

When the kids are home on a weekday because school is out we find an excuse to craft! And with St. Patrick's Day right around the corner, we decided to make a festive t-shirt for my daughter to wear to school on the holiday. With a cardboard roll, some q-tips, and green paint, you can easily make a shamrock shirt in 30 minutes. And, if your child is as excited to craft as mine was, you may also end up with a rainbow and pot of gold over your four leaf clover too! Painting with q-tips is … [Read More]

Family

Back to School Teacher Appreciation Gifts + a Tutorial

It’s the start of a new school year and to show our teachers some back to school love, we’ve created this simple back to school teacher appreciation gift! Ahhhh! The most wonderful week of the year. Back to school week. Where the kids head back into the loving arms of their teachers and mama gets […]

How to Make a DIY First Day of School Sign Using PicMonkey

My oldest will be heading to kindergarten in just two short weeks. And while I’m definitely ready for this next step in his adventure, I want to make sure to capture as many memories as I can. So after seeing a lot of printables floating around, I decided that instead of finding something someone else […]

Back to School Lunch Ideas and Tips

Ever start thinking of school lunches and wonder what the heck you’re going to pack? Well here are some great back to school lunch ideas and a few tips that might help you out! My son isn’t quite ready for kindergarten yet but will be there next year and we’ve already exhausted a few great […]