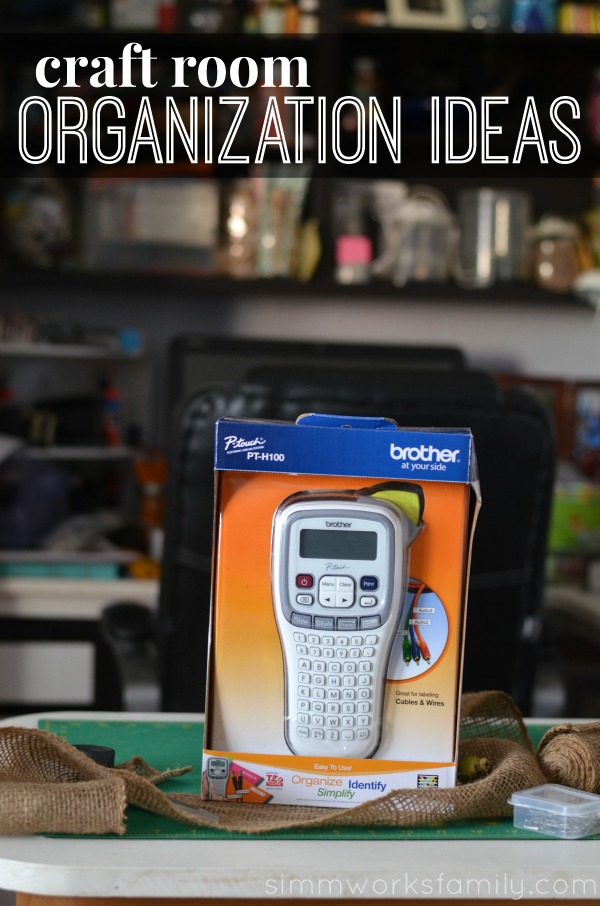

I participated in an Ambassador Program on behalf of Mom Central Consulting for Brother P-touch. I received a product sample to facilitate my review and promotional item as a thank you for participating.

The holidays are upon us! And for me that means busy season. Not only are we crafting up a storm this time of the year but I’m also working a lot as well. So that means organization is key.

The holidays are upon us! And for me that means busy season. Not only are we crafting up a storm this time of the year but I’m also working a lot as well. So that means organization is key.

Since my craft room and office are the same workspace (shared with the kids playroom) I really need to stay on top of the organizing so that nothing goes missing. Because it has before.

My secret weapon for tackling my craft room organization is the Brother P-touch PT-H100 label maker. With it’s ease of use, multiple options, and quick printing, I can have everything I need to get my craft on right in front of me and easily identifiable. [Read more…]