Before our son was even born my husband and I began discussing college savings for him. Coming from a family where I was expected to pay my own way through school and having a husband who was lucky enough to have parents who were able to save up for him made us both realize how important it was to tackle this issue early on.

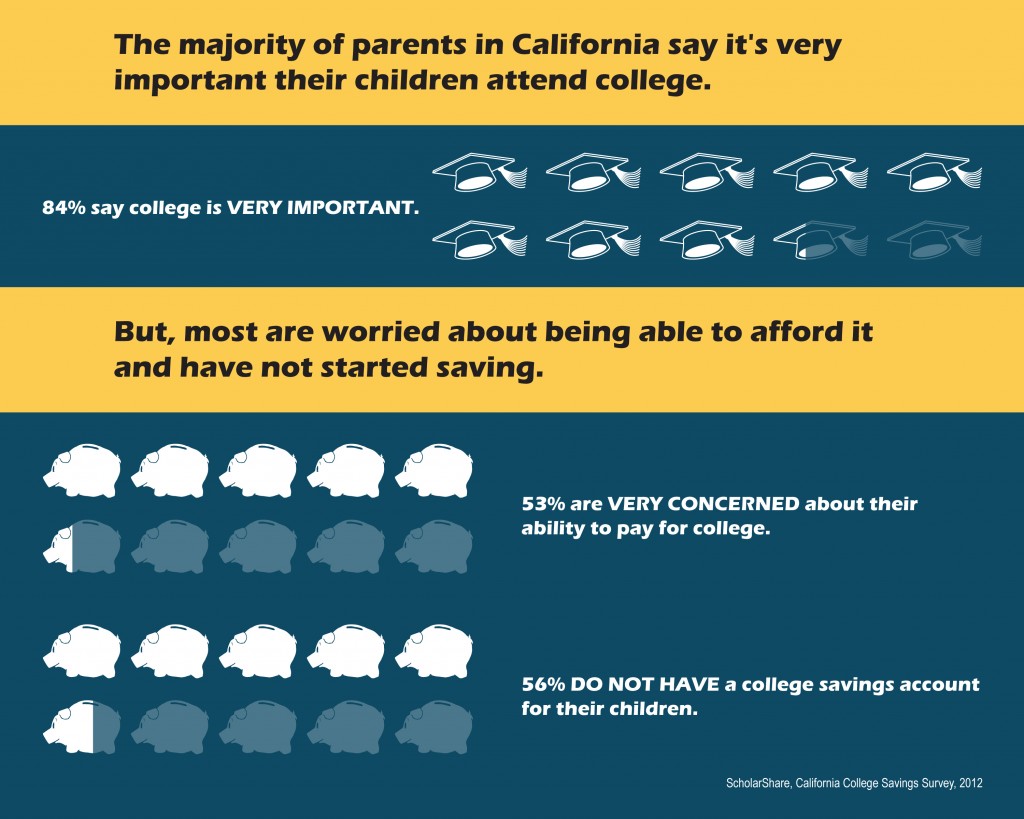

A few weeks ago I posted a poll on saving for our children’s college education. And the results were quite different from what I expected. Half of those polled had not yet considered a college savings plan for their child and weren’t quite sure what they were going to do once the time came.

Some of my readers voiced concern over if what they were saving was even enough to make a difference. So when I had the opportunity to sit down with some great folks from ScholarShare who knew the most about 529 savings plans I was able to have all of mine and my readers questions answered.

And I left our meeting a little more relieved at the options we have ahead of us for our children.

1. $25 is all you need to start –

1. $25 is all you need to start –

You don’t need a good chunk of change to put down to start a ScholarShare account for your child. Unlike using a middleman, like the bank we used for our son, you just need $25. That’s a huge difference from the $500 we had to come up with to start my son’s 529 plan!

2. Guidance is just a phone call away –

Unlike other providers who deal with different types of loans, ScholarShare is solely focused on college savings. So when you have a question, a problem, or just need a little guidance you can call up a ScholarShare representative and know that the person you’re talking to has knowledge about your account and can help.

Plus, you will have access to your account 24/7 online and reports are easily viewed and can be emailed to you.

3. We cut out the middle man with ScholarShare –

By cutting out the middleman we’re reducing the fees we pay to the institution or financial adviser who is handling our account. And since in our case we didn’t even get as much as a phone call to let us know how our plan was doing it’s an easy choice to make the switch.

4. It really is simple to roll over –

Now that we’re ready to transfer our 529 college savings plan from our current provider to ScholarShare there’s no hassle in doing so. We simply call over and give them the necessary information they need to access our account.

And not only is it simple to roll over, if friends and family want to contribute to your child’s college savings they don’t need his social security number to do so! You can even send out emails around special holidays and birthdays letting them know they can contribute to your child’s 529 plan in lieu of a gift. And these emails can get sent automatically!

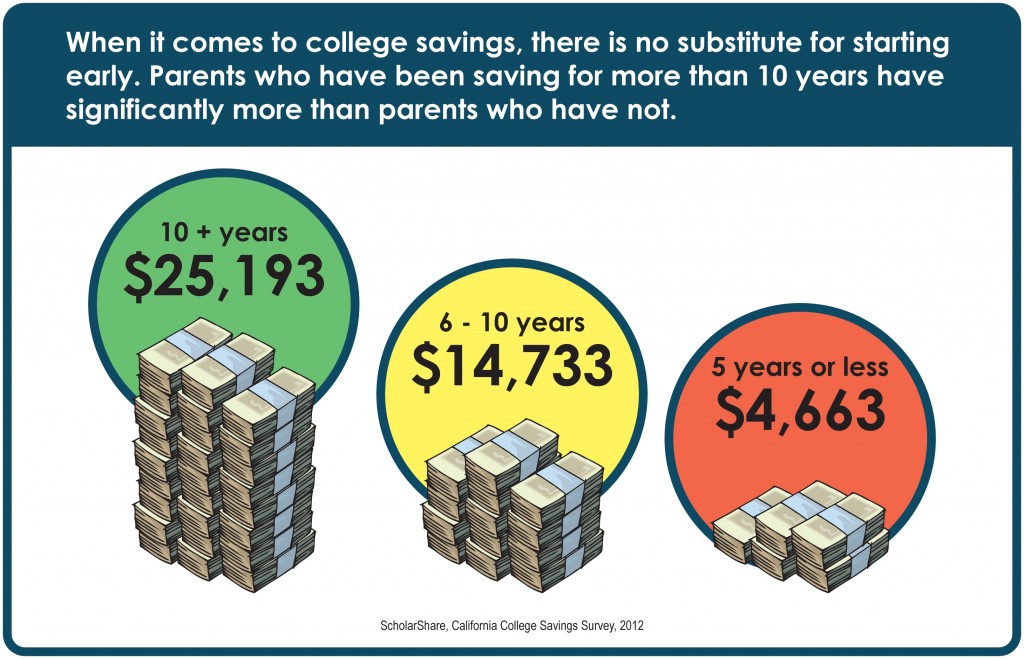

5. Any savings, no matter how small, is still savings –

The biggest thing I took away from my meeting with ScholarShare is the fact that anything you are putting away is more than what your child has. Even if it’s just $25 a month, you can make a difference when it comes to your child’s education! Plus, with ScholarShare, your child doesn’t have to use it for a big university. If they prefer culinary school or another alternative they can still use the money for their education!

Moving Forward with our ScholarShare 529 Savings Plan

Now that I’ve gotten a chance to speak with representatives from ScholarShare and know how ScholarShare can benefit myself and my children I’ve already made the decision to switch my son’s 529 plan over to ScholarShare and finally start my daughter’s plan.

The feeling of relief at finally knowing what’s going on is such an awesome feeling and I hope others can find that same relief.

If you have any other questions about Scholarshare I highly suggest checking out their website. You can also find ScholarShare on Facebook and connect with them via twitter at @ScholarShare529.

Disclaimer: This is a sponsored post from One2One Network and Scholarshare. All opinions stated are my own.

A�But in fact, the history of Legos toys dates back many more years.

Christmas comes round quickly and is almost upon us yet again.

But are you aware that Lego also produce electric toy trains and that they not only have

trains, but also locomotives, track, rolling stock, train stations, signal houses and

a whole load of other track side buildings and they all have the logo construction theme running through them.

We have started saving already for our kids education. It is so important!

Planning for my kids’ College education is on my list. I need to look into it and start one.

I so needed to read this!! Thank you!

It’s never too early to start saving for college. This sounds like a great way to get started!

$25 I can handle and it’s never too late to start. I’d rather our family and friends contribute to our son’s account when a birthday or Christmas rolls around.

I keep telling myself we need to get going on college funds for the younger kids but I keep putting it off. Definitely need to look into doing something like this.

Wow! $25 is all ! That’s awesome! I always assumed I had to start with more than that.