We’re sharing how to teach kids to be SMART savers plus an easy DIY Save Spend Give Piggy Bank for them to make for their earnings.

Do your kids always want to spend everything they get? Or are they more cautious with how they use the money they receive? Whether it’s a weekly allowance, money from birthdays, or money they earn selling lemonade on the corner, kids are never too young to start learning about how to be smart savers.

With three kids at home, we knew we needed to come up with a simple plan that each of them could understand. From our 2-year-old to our 8-year-old, we use the same system. And it’s broken down into the simplest form for them to grasp. We’ve come up with 3 categories for them and it all has to deal with three simple words: save, spend, give.

3 Categories of a Budget

Step 1: Save money of your own,

Step 2: Spend your money wisely by determining what you need versus what you want,

Step 3: Give your money, time, or things with people who need it.

How to be a SMART Saver

Once you have that broken down, it’s time to start thinking of what or why you want to save. There are 5 steps to putting together a smart savings goal:

1. Specific: What exactly do you want to accomplish?

2. Measurable: How will you know you met your goal?

3. Attainable: Can you really achieve your goal?

4. Relevant: Why is this goal important to you?

5. Timely: How much time do you need to accomplish the goal?

Try to talk with your kids about these goals and see if they can come up with their own!

Get Started!

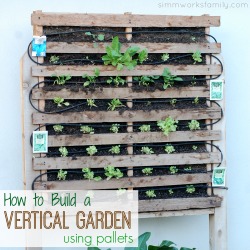

Let the kids construct their own Save Spend Give Piggy Banks by gathering 3 containers, decorating them as you prefer, and labeling each one of the following – “Save, Spend, Give.” Put your money in the appropriate bank as you receive it and watch it add up.

We simply grabbed some containers and labels from the dollar store and kept it simple! But you can get as creative as you’d like. To see how we made ours, watch the video below:

video here

Are your kids learning to manage the money they’re receiving?

Love this project? Read more!

- How to Inflate a Balloon Using Science

- Women and Finances: The Truth About How We Manage Money

- Money Management Tips: How to Prepare for an Emergency

Pin this article for later!

Click the Pin button on the image below to save for later.

With the budget we’ve set in place we’ve limited the funds we have for things like eating out and grocery shopping. So we’ve had to become quite frugal in the way we spend our money on food and necessities. One of the ways that has helped me reduce my grocery bill quite drastically is by shopping with coupons. I thought I could share my “method” with you.

With the budget we’ve set in place we’ve limited the funds we have for things like eating out and grocery shopping. So we’ve had to become quite frugal in the way we spend our money on food and necessities. One of the ways that has helped me reduce my grocery bill quite drastically is by shopping with coupons. I thought I could share my “method” with you.